What does it mean to be a 403(b) fiduciary?

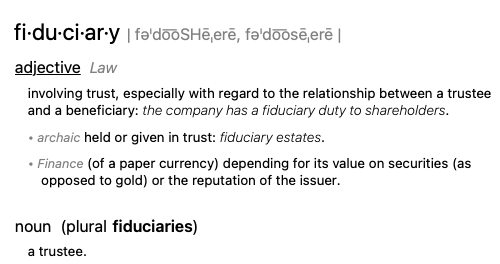

In our schools, and often at the board level, you hear the word fiduciary quite frequently. As you can see by the definition below, being a good fiduciary is about trust. It also doesn’t end at the board level.

From a human resource perspective, the most senior-level administrators are also fiduciaries to the faculty and staff. They control unnecessary expenses, determine salaries, and build a basket of employment benefits for everyone in the organization. Most member schools offer a retirement plan as an employee benefit. So how does being a good fiduciary relate to retirement plans? Those in the position of designing a retirement plan know—there are numerous factors involved, including eligibility, vesting, matching, and fees—and not just the fees the school pays for administration of the plan, but the fees participants incur through the array of funds offered. Being a good fiduciary on behalf of your school’s retirement plan means looking at ALL fees and ALL options. Below is a list of questions you should ask when considering any new retirement plan, whether it be a school-sponsored plan or a new group plan (or MEP – Multiple Employer Plan).

- Will this change affect my plan participants and how?

- Will my plan participants save money? (help them retire better)

- Will the school save money? (audit, 5500 filings, etc.)

- Have I looked at all the options available to me?

- Will the plan administrators save time?

- Are the fees paid by both the school and participants transparent?

- Will this completely relieve the fiduciary responsibility of my board?

(The quick answer is no; however, the responsibility can be shared to reduce the burden on the board when you choose the right partners.)

For almost 50 years, MISBO has been saving our schools money and vetting consortium partners you can trust and who understand independent schools. We designed a multiple employer plan that took years to build, and the questions above guided us through the entire process. If you’re interested in learning more about The Independent School Group Retirement Plan, register to attend one of our upcoming information sessions. We also encourage you to check out our confidential MEP pricing (member login required) and as always, we’re happy to answer any questions you may have.

Michelle Shea, Certified Plan Sponsor Professional (CPSP)

Vice President

MISBO